Software Innovation Strengthens Clean Tech Financing, for Everyone

This article originally appeared on the official blog for the American Council On Renewable Energy.

This is the final installment of a 3 part series

We have a bright future ahead of us if we harness the full potential of our country’s renewable energy resources. Transforming the way we produce and distribute energy will not only be good for our environment, it will also be great for our economy—spurring innovation and creating jobs. So how do we make the most of the opportunity that lies before us?

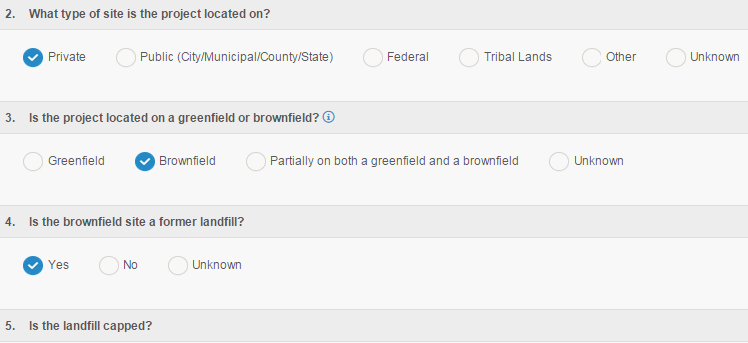

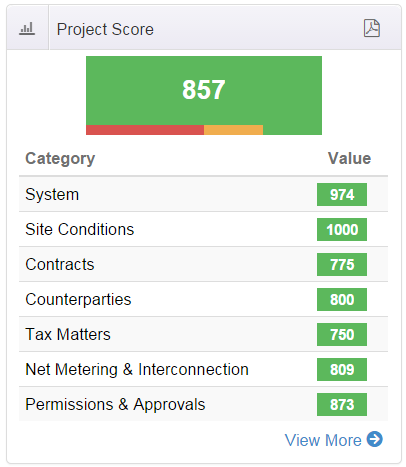

In part 1 of this blog series, the challenges currently being faced by developers and financiers who work in the C&I solar space became clear. The truSolar Working Group has sought to address the sector’s problems by creating a “Rosetta Stone” risk screen that can lower project soft costs, increase transparency, and facilitate securitization of solar asset portfolios via standardized project scoring. Part 2 of the series outlined the features of beEdison: a cloud-based software platform designed to operationalize the truSolar risk screen. Essentially the TurboTax® equivalent for a complex solar diligence arena, beEdison software provides a much needed tool to streamline project risk assessment. Ultimately, software innovations like beEdison are allowing the C&I sector to overcome financing roadblocks. So, what implications can the necessary trajectory of truSolar and beEdison have for the clean energy economy?

By 2018, wide adoption of truSolar and beEdison can unlock hundreds of millions of dollars in additional annual investment in non-residential solar. Higher conversion ratios and soft cost reductions contribute to this additional capital deployment, along with proceeds from securitizations that have been facilitated by the widespread adoption of truSolar risk scores. Of course, there will also be secondary benefits that impact our environment. For instance: an additional 1.6GW of solar installed by 2018 would reduce carbon emissions by approximately 1.6 million metric tons: the equivalent of removing 351,000 cars from our roads.

It’s important to realize that while these benefits sound very appealing , they are really just the tip of the iceberg. There is enormous potential to replicate the “truSolar diligence standard & beEdison software platform” model in adjacent technology spaces and economic markets. Effective collaboration between America’s renewable energy industry leaders can result in broadly accepted due diligence standards that are tailored for energy storage, energy efficiency, biomass, geothermal, wind and other complex asset classes like infrastructure. Platforms like beEdison can also be re-engineered to service players in each additional market space.

, they are really just the tip of the iceberg. There is enormous potential to replicate the “truSolar diligence standard & beEdison software platform” model in adjacent technology spaces and economic markets. Effective collaboration between America’s renewable energy industry leaders can result in broadly accepted due diligence standards that are tailored for energy storage, energy efficiency, biomass, geothermal, wind and other complex asset classes like infrastructure. Platforms like beEdison can also be re-engineered to service players in each additional market space.

Replication and market expansion within our borders makes intuitive sense, but how about a concerted effort to impact global markets? The American energy landscape is unique in many respects, and yet the challenges that clean energy advocates face here are also evident on other continents. We live in a global village where capital is mobile, and energy project risks are often opaque. If the United States can benefit from diligence standardization, then so can Europe, Asia, Australia, Latin America and Africa.

The truSolar Working Group, currently led by the Rocky Mountain Institute, and the beEdison team know there is a lot of work ahead. Both are committed to breaking down the market’s resistance to change by building trust between partners, and by securing acceptance of the truSolar Risk Screen by industry participants, including financiers, rating agencies and solar project developers. With the right teammates and partners from all renewable energy sectors, we can radically change the landscape for clean-tech financing forever, and for the better.