Oversupply of Deals to Drive-up Yields through 2016YE

This is part 1 of a 2 part series

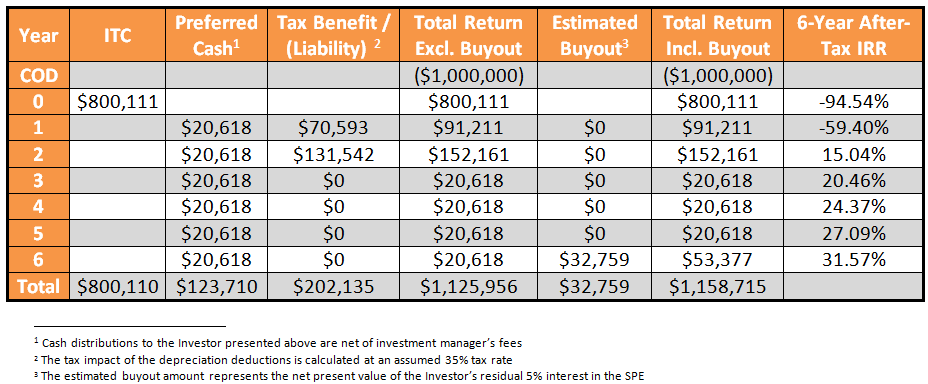

In the US today, solar photovoltaic projects receive an Investment Tax Credit (ITC) of 30% of eligible costs. Project equity sponsors often look for an investor (called the Tax Equity Investor) to co-invest in their projects and monetize the ITC. Capital from Tax Equity Investors (called Tax Equity Investment) constitutes approximately 35% of the total capital required for each project. The remainder is provided by the project sponsor and term debt, if applicable. For smaller projects, Tax Equity Investments can earn a 30% IRR or more over 6 years. All of the invested funds are returned via tax savings within 24 months. Cash dividends through annual coupons yield a further 15+ percent. Typically, the manager of a Tax Equity Fund (several Tax Equity Investments made simultaneously) will screen investment opportunities, conduct diligence, manage the investment, oversee project operations and distribute returns to Tax Equity Investors.

Tax equity continues to be king of the US solar project capital stack. With few institutional, fewer corporate, and even rarer, individuals with both a tax obligation to off-set and the passive gains that qualify – finding and closing on tax equity is usually more difficult than securing sponsor equity and long-term debt.

Demand for tax equity is increasing in a growing marketplace dependent upon it. Also, the reversion of the Investment Tax Credit, expected after December 31, 2016, will only increase deal supply, as 2017 projects are rushed into completion during 2016. New entrants into the commercial solar segment are further increasing demand for smaller ‘bite-sized’ investments – at sizes below traditional institutional minimums and corporate preferences of typically $10 million per investment. Demand for Tax Equity Investments will outstrip the supply of capital from existing investors between now and the end of 2016. Even when project developers and sponsors overcome these supply-demand obstacles, a final barrier can make closing tax equity difficult – middle market entities with unrated credit backstopping the long-term cash flow of the solar project. Institutional Tax Equity Investors have traditionally invested in projects involving rated credits only, shying away from lucrative, unrated middle market opportunities. Middle market and smaller balance-sheet power purchasers create a big challenge for sellers and a big opportunity for Tax Equity Investors – at least for those with access to deal flow and a ready plan to invest reliably. The market is beginning to see new Tax Equity Funds established to support an underserved markets segment – investments of $1–2.5MM per project. Provisional returns on investments of $1MM are shown below.

As this market imbalance grows over the next 18 months, overall yields on Tax Equity Investments will likely increase along with returns on cash and tax-cash multiples. This imbalance will further a Tax Equity Investor’s-market and a boom for such investments before December 2016.

PARTNERSHIP FLIP INVESTMENT STRUCTURE OVERVIEW

Tax Equity Investments are made through a special purpose LLC (an “SPE”) using a Partnership Flip Structure. Project sponsors are responsible for development, construction and commissioning of a project. After the investment manager’s diligence, the tax equity investment is made just before the project is commissioned. The Tax Equity Investor co-invests alongside the project sponsor and enjoys a priority equity position. The Tax Equity Investor and project sponsor own 99% and 1% of the SPE, respectively, until the investment hurdles are met. Once a predetermined hurdle is met, the ownership interests in the SPE flips – the project sponsor then owns 95% of the SPE and the Tax Equity Investor owns the remaining 5% interest. At this point, the Tax Equity Investor typically elects for their residual interests to be bought out by the project sponsor. 100% of Tax Equity Investment is returned through the ITC and accelerated depreciation. In addition, preferred cash distributions equaling 10-15% of the Tax Equity Investment are made via annual coupons and, if a buyout is elected, an additional payment in exchange for the residual 5% interest. NOTE: The IRS treats the ITC and depreciation benefits as passive losses, which for individuals generally needs to be matched against passive income. Corporations do not have this requirement. Please consult a tax advisor for guidance.

ABOUT DISTRIBUTED SUN

Distributed Sun LLC (“DSUN”) is a renewable power developer and Tax Equity Investment manager. DSUN has operating assets in 7 US states and a development pipeline in 12 US states. DSUN has screened nearly $12B of investment opportunities in renewable energy – from 226 unique network partners. DSUN’s proprietary investment methodologies, screening and underwriting practices are used by hedge funds, institutional and individual investors. DSUN has made Tax Equity Investments in several projects and will continue to service the growing demand for such investments. Send an email to Jeff Weiss at jeff@distributedsun.com to learn more about the Tax Equity Investments and the Investment Tax Credit.

DISCLAIMER – This article should not be relied upon and is not a substitute for the skill, judgment and experience of an investor, its management, employees, advisors and/or clients when making investment and other business decisions. This blog article is not a solicitation to invest, investment advice or a tax opinion – please contact your counsel for advice.