Simplifying Solar Diligence: A TurboTax®-like Solution

This article originally appeared on the official blog for the American Council On Renewable Energy.

This is part 2 of a 3 part series

It’s time to relax. The day has passed and we can all finally let out a collective sigh of relief now that we’ve successfully navigated the obstacle course that is filing our annual income tax return. Luckily, almost no one needed to read the 3,863 page long Internal Revenue Code to figure out how to complete their taxes. Most of us were probably smart enough to use TurboTax®, or another tax return preparation tool like it. If you would have filed your yearly income taxes by following the guidelines presented in the Internal Revenue Code, it would have taken time—lots of it—and you’d likely miss key information. Like taxes have taught us, it’s much easier to use a technology platform to simplify complex processes. As it turns out, solar diligence isn’t much different.

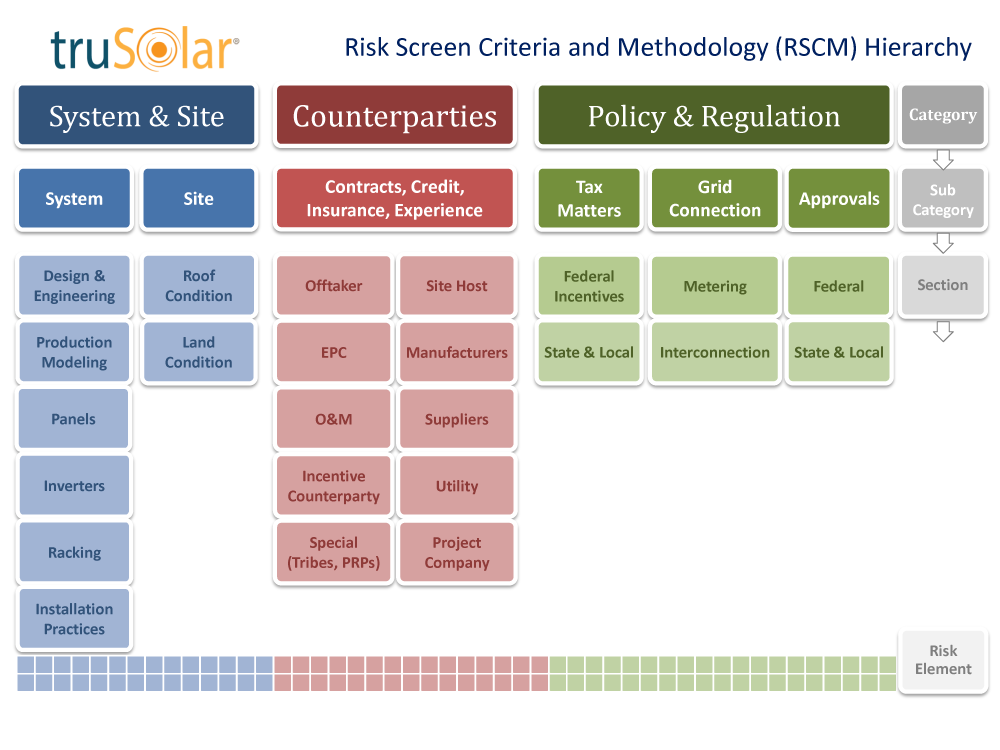

In last week’s blog, the truSolar risk screen standard for commercial and industrial solar projects was highlighted. truSolar is much like the Internal Revenue Code, in that it sets comprehensive guidelines and rules that should be followed. You could review the truSolar standard in its entirety in order to score your solar project’s risk profile, but that would consume valuable time. So here’s the good news: there’s a software platform like TurboTax® to help streamline a project’s truSolar assessment.

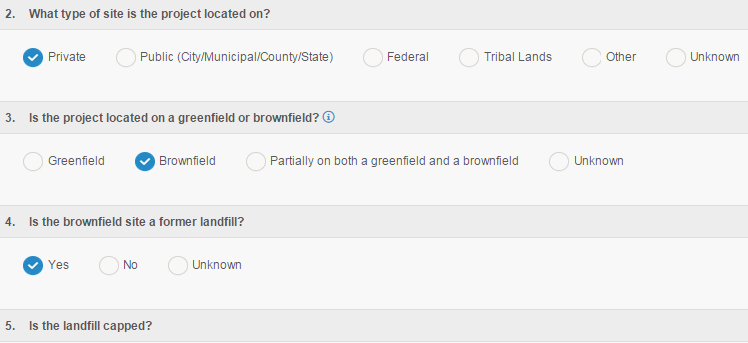

beEdison is a cloud-based technology platform that operationalizes and professionalizes the truSolar standard into a quick and efficient survey. Much like how TurboTax® asks the right questions to complete filing scenarios, beEdison asks questions unique to a project. For example, a project developing a ground mount array, won’t be asked questions about the structural integrity of a roof.

While TurboTax® electronically prepares tax filing documents, beEdison produces a comprehensive diligence report to share with project partners. Additionally, beEdison’s platform provides recommendations to mitigate project risk and improve a project’s quality, while an online deal room securely stores project documents. It’s like Dropbox, only specifically tailored for solar project documentation. A user can upload multiple files with the click of a button and easily share documents with project partners.

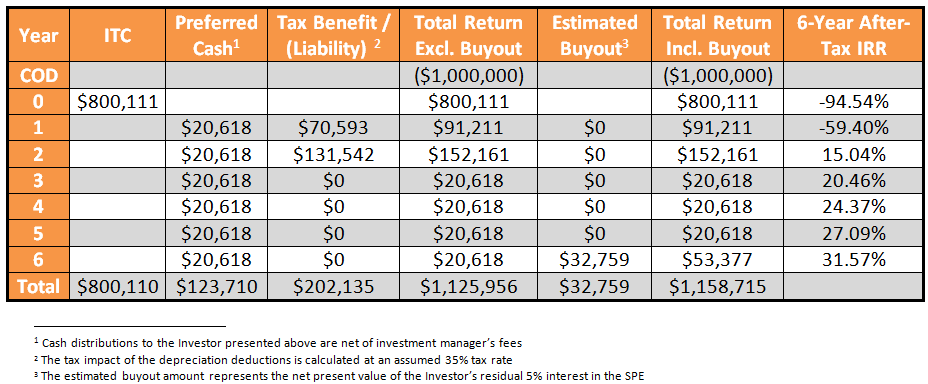

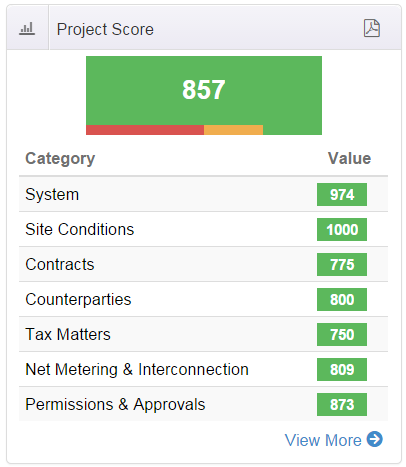

The most anticipated TurboTax® display is the one that reveals your annual tax refund or payment. Similarly, beEdison’s Dashboard reveals a project’s truSolar score which effectively summarizes a solar project’s risk profile, and instantly allows investors to assess whether the investment opportunity in front of them aligns with their risk appetite.

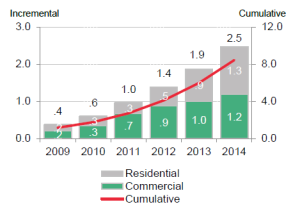

Similar to the renewable energy sector at large, as the commercial and industrial solar sector realizes its full potential; it’s still constrained by the complexities of project development. There is no standardized way to assess the risks of C&I solar assets. Innovative tech developments like beEdison will alleviate headaches associated with project development and diligence, and help solar asset buyers and sellers complete more projects with more efficiency.

In next week’s final blog post we’ll look at the future of truSolar and beEdison and the impacts each can have on a rapidly evolving solar industry. Stay tuned, especially if you are interested in asset securitization and secondary markets.