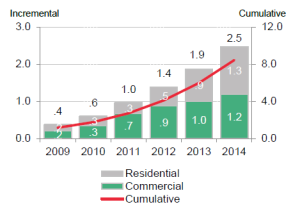

According to Bloomberg New Energy Finance, the United States deployed 1.2GW of commercial solar in 2014. (1) This may sound like good news, but the graph to the right clearly shows that in 2014, America’s residential sector overtook the commercial sector for the first time in terms of annual PV capacity deployments. This development begs the question: what is preventing America’s non-residential solar sector from scaling at a faster rate, noting the country consumes more than twice as much electricity in the commercial and industrial segments today as it does in residential?

In many respects, it is easier to deploy solar on the rooftops of homes than on commercial buildings. Residential off-takers have credit scores (FICO) that can be used by investors to determine payment risk. The segment has been largely “productized” and lends itself to standardized contracts and workflow processes. Residential solar companies close sales “on the spot” and without negotiating. Installation crews can drive to one home, install a system, then drive a few doors down and essentially install the same system, with practically zero impact to grid stability, the environment and other regulatory matters. Non-residential solar companies face nearly the opposite on each of these issues. Their installers are rarely building the same type of system or in the same zip code or city. Larger systems face interconnection and permitting challenges that are highly bespoke. Every deal is a negotiation. Understandably so, the commercial segment is highly fragmented. Standardized contracts and uniform methods for evaluating and rating development assets are only just now taking root. And most importantly, there is no reliable, accepted, third-party method for scoring unrated commercial credit risk. Until now.

Over 90% of commercial real-estate in the US is owned by unrated credit entities. Cracking the code of scaling C&I solar, therefore, revolves largely around the establishment of a reliable commercial credit scoring methodology.

In some ways, it strains the imagination to understand why this has not already been achieved for commercial solar. In addition to S&P, Fitch and Moody’s, there are another 7 NRSROs (nationally recognized statistical ratings organizations). There are 42 credit rating agencies globally and 34 credit reporting agencies.

The vast majority of non-residential solar power purchasers are small and medium sized enterprises. The options available to reliably assess their credit worthiness are limited:

• Dun & Bradstreet provides credit profiles for thousands of businesses, but D&B’s underlying data streams are mostly self-reported by businesses, which means the resulting scores have limited reliability.

• CRAs like Experian utilize third party data to generate credit profiles for businesses. These reports may be more reliable than D&B’s offerings, but they focus largely on payment histories, providing limited insight into current financials or how businesses and their respective industries may perform over the mid-to-long term.

• NRSROs like S&P focus mostly on entities with publicly traded debt instruments, thus ignoring the universe of unrated credits that comprise the vast majority of potential non-residential off-takers.

Building upon the foundation of credit risks identified by truSolar®, the beEdison team has created a standard approach to reliably assessing off-taker credit risk. In doing so, beEdison is helping to unleash the full potential of nonresidential solar. Credit assessment is offered to partners as a service, and is being automated as a separate credit module within the beEdison platform. These credit diagnostics leverage third-party data, standard ratio and comparables analysis with proprietary scoring to rate prospective counterparties along seven key dimensions:

1. Payment history;

2. Financial health;

3. Performance relative to industry peers;

4. Counterparty industry outlook;

5. Implied credit rating;

6. Liens, judgments and bankruptcy profile;

7. Capacity to meet PPA commitments during financial downturns.

Contact credit@beEdison.com for more information about the company’s counterparty assessment services.

(1)BNEF. (Feb 4, 2015). Sustainable Energy in America Factbook – 2015. Page 77.